Product Compliance, U.S. Government Regulations, and Trade Agreements

When providing product for a publicly funded project, materials suppliers must comply with some very strict rules and regulations regarding domestic sourcing of materials. Understanding which rules apply for a specific project can be difficult, especially with the names the government has selected. For example, two of the most common acts are the Buy America Act and the Buy American Act. Although only an “n” separates the two, the stipulations for sourcing and manufacturing are quite different.

Here are basic principles of the most common regulations, as an intro to what’s out there and to help you avoid making expensive mistakes.

Buy America Act

The Buy America Act applies to projects for the sub-agencies of the Department of Transportation (i.e. FAA, Federal Highways Administration, Federal Railroad Administration, Federal Transit Administration).

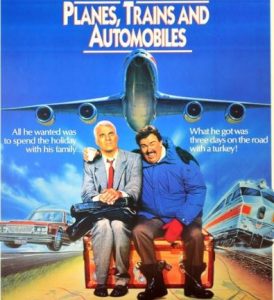

We refer to this as the “planes, trains and automobiles” act (not to be confused with the classic comedy of the same name starring Steve Martin and John Candy!). These projects and their applicable regulations typically require 100% domestic content. The Buy America Act does have provisions for waivers due to lack of domestically available sources. These waivers are common for door hardware products, which virtually all have globally sourced components.

We refer to this as the “planes, trains and automobiles” act (not to be confused with the classic comedy of the same name starring Steve Martin and John Candy!). These projects and their applicable regulations typically require 100% domestic content. The Buy America Act does have provisions for waivers due to lack of domestically available sources. These waivers are common for door hardware products, which virtually all have globally sourced components.

Buy American Act

The Buy American Act applies to most federal and state government projects. Under the Buy American Act, foreign components and sub-components may be sourced in some instances, but the end-product must be determined to have been “manufactured” in the US.

The Buy American Act applies to most federal and state government projects. Under the Buy American Act, foreign components and sub-components may be sourced in some instances, but the end-product must be determined to have been “manufactured” in the US.

This is pretty straightforward, but gets a little complicated when you take into account the Trade Agreement Act which grants equal treatment to products from designated trade partner countries (i.e.: NAFTA, Free Trade Agreement Countries, WTO countries, etc.). This stipulation, as outlined in the Federal Acquisition Regulations, allows for the “procurement of construction services” to come from these designated trade agreement countries if the project’s total value exceeds certain thresholds. These thresholds are established bi-annually by the U.S. Trade Representative and published in the Federal Register. For FY18 and FY19, they are set at $10.4mm for NAFTA (Canada, Mexico) and $6.932mm for most other trade agreement countries, including the WTO countries of Japan and Taiwan.

American Iron & Steel Act, Pennsylvania Steel Act

Two other acts that relate directly with hollow metal doors and frames are the American Iron and Steel Act and the Pennsylvania Steel Act. Both of these require 100% domestic steel. The Pennsylvania Steel Act applies to all Pennsylvania state business, whereas the American Iron and Steel Act applies to the U.S. Environmental Protection Agency and recipients of funds under the Clean Water State Revolving Loan Fund and Drinking Water State Revolving Loan Fund, essentially, federally-funded water and wastewater treatment facilities.

Failure to comply with applicable regulations can result in costly repairs or replacements. This is especially true for hollow metal doors and frames made from steel. If frames are found not to be in compliance they must be ripped out, causing a domino effect of repairs that can add up to a very large bill. The key is identifying these projects and requirements before the project is quoted.

If you’re not sure whether a project falls into one of these categories, reach out to a Door Security Solutions representative for expert help.

No comments yet - you can be the first!